Check Registers: Learn How to Develop the Ability to Organize Transactions

Develop the ability to organize transactions, such as deposits, checks, and other expenses, and accurately record them in a check register.

A step-by-step guide for maintaining check registers

A written record of the transactions in a checking account is a check register.

The amount of money in the account is a balance.

The money that is taken out of the account is a withdrawal. It is subtracted from the balance.

Here’s a step-by-step guide for maintaining a check register:

- Start with a blank check register: You can buy a check register at a bank or office supply store, or create one on a piece of paper or in a spreadsheet program.

- Record your starting balance: Write your starting balance at the top of the register, usually on the first line.

- Record each transaction: Every time you deposit money, write the amount in the “Deposit” column of the register. If you write a check or make a withdrawal, write the amount in the “Payment/Debit” column. Be sure to record the date, the payee or recipient, and a brief description of the transaction in the corresponding columns.

- Calculate your balance: After each transaction, calculate your new balance by adding or subtracting the transaction amount from the previous balance. Write the new balance in the “Balance” column.

- Reconcile your register: Reconciling your check register means comparing it to your bank statement to ensure that your records match the bank’s records. To do this, start with the ending balance on your bank statement and add or subtract any deposits or withdrawals that are not on your statement. Then, compare this adjusted balance to the ending balance in your register. Make sure they match or figure out why they don’t.

- Keep your register up to date: It is important to record transactions as soon as possible so that you always have an accurate record of your account balance.

- Review your register regularly: Reviewing your check register regularly will help you track your spending, avoid overdrafts, and plan your budget.

By following these steps, you can maintain an accurate and up-to-date check register, which can help you stay on top of your finances and avoid overdrafts or errors in your account.

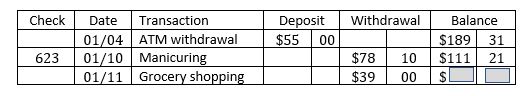

Check Registers – Examples 1

Calculate the missing balance in Eva’s check register.

Solution:

She had a balance in her account of \($\)111.21. She paid \($\)39.00 for grocery shopping.

To calculate the new balance, subtract the grocery shopping from the previous balance, \($111.21-$39.00=$72.21\).

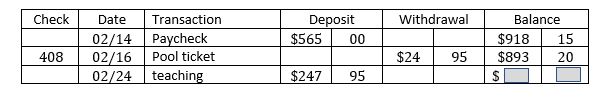

Check Registers – Examples 2

Calculate the missing balance in Kevin’s check register.

Solution:

On February 24, Kevin deposited money from teaching. Before depositing the money, he had a balance in her account of \($\)893.20.

To calculate the new balance, add the amount of the teaching money, \($893.20+$247.95=$1141.15\).

Related to This Article

More math articles

- Introduction to Complex Numbers: Navigating the Realm Beyond the Real

- How to Divide Polynomials Using Synthetic Division?

- 7th Grade NYSE Math FREE Sample Practice Questions

- 5th Grade MEAP Math Worksheets: FREE & Printable

- Full-Length 6th Grade STAAR Math Practice Test-Answers and Explanations

- The Ultimate Adults Algebra Refresher Course (+FREE Worksheets & Tests)

- Top 10 ISEE Middle-Level Math Practice Questions

- SSAT Middle Level Math Practice Test Questions

- Geometry Puzzle – Challenge 76

- Can You Train Your Brain to Think Like a Mathematician?

What people say about "Check Registers: Learn How to Develop the Ability to Organize Transactions - Effortless Math: We Help Students Learn to LOVE Mathematics"?

No one replied yet.